Analysis India: The global diabetes treatment medical devices market is undergoing a quiet but decisive transformation. What was once viewed as a supporting segment of diabetes care has steadily evolved into a central component of long-term disease management. Market data from 2015 to 2030E reveals a pattern of consistent expansion, regional realignment, and deeper integration of medical devices into routine treatment pathways.

This evolution reflects not a short-term spike in demand, but a structural shift in how healthcare systems approach chronic metabolic diseases.

From Steady Expansion to Accelerated Growth

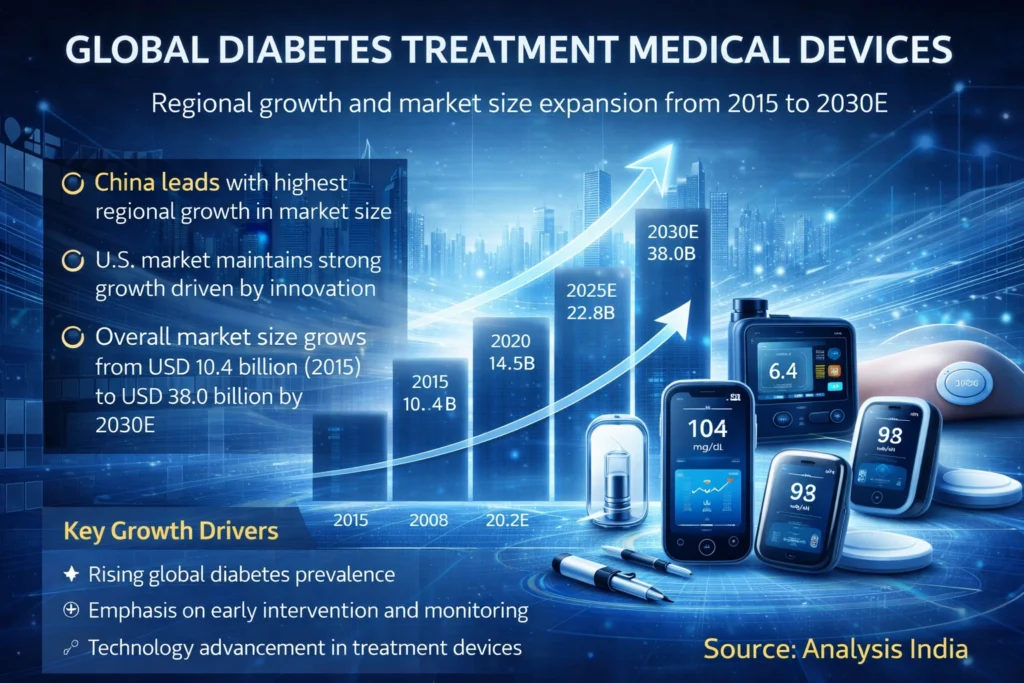

In 2015, the global diabetes treatment medical devices market was valued at USD 10.4 billion. By 2020, it reached USD 14.5 billion, supported by gradual adoption of insulin delivery devices and glucose monitoring systems across developed healthcare markets.

The period after 2020 marks a turning point. Growth accelerates as diabetes treatment increasingly relies on continuous, device-based management rather than episodic clinical intervention. The market is projected to reach USD 22.8 billion by 2025E and USD 38.0 billion by 2030E, underscoring the rising importance of medical devices in long-term care strategies.

China’s Expanding Influence

China has become the most prominent growth engine within the global diabetes treatment medical devices market. Between 2015 and 2020, the market expanded at a CAGR of 21.0 percent, reflecting rapid healthcare modernization and a growing diagnosed diabetes population.

Although growth moderates to 15.1 percent CAGR during 2020 to 2030E, the absolute contribution continues to rise. Adoption is expanding beyond urban hospitals into community healthcare systems and home treatment settings, reinforcing China’s long-term strategic role in global market expansion.

United States: Innovation as a Growth Anchor

The U.S. remains a cornerstone of the global diabetes treatment medical devices market, combining scale with technological leadership. From 2015 to 2020, CAGR stood at 7.0 percent, characteristic of a mature market.

During the forecast period, growth accelerates to 10.5 percent CAGR. This reflects sustained innovation, increasing integration of digital health technologies, and a strong focus on personalized diabetes treatment solutions. The U.S. continues to influence product development standards and adoption trends worldwide.

EU5: Controlled but Meaningful Progress

The EU5 region follows a measured growth path within the global diabetes treatment medical devices market. CAGR of 5.2 percent from 2015 to 2020 highlights regulatory discipline and structured healthcare delivery.

From 2020 to 2030E, growth improves to 8.8 percent. This shift reflects increasing alignment between diabetes treatment devices and preventive healthcare policies, with growing emphasis on long-term disease cost management across European healthcare systems.

Emerging Regions Gain Strategic Significance

Outside the major markets, emerging regions collectively strengthen their presence in the global diabetes treatment medical devices market. CAGR rises from 5.9 percent during 2015 to 2020 to 9.4 percent during 2020 to 2030E.

Improving healthcare infrastructure, broader access to diagnosis, and gradual affordability improvements support adoption. While fragmented individually, these markets together contribute meaningfully to global revenue growth.

Key Market Drivers

The expansion of the global diabetes treatment medical devices market is driven by structural healthcare trends rather than short-term fluctuations. Rising global diabetes prevalence continues to place sustained pressure on healthcare systems to adopt long-term treatment solutions. Medical devices provide continuity of care that traditional treatment models cannot easily replicate.

Another key driver is the growing emphasis on early intervention and continuous disease monitoring. Devices designed for regular use support improved treatment adherence and clinical oversight. In parallel, technological advancement continues to enhance device usability, accuracy, and patient comfort, making long-term adoption more feasible across age groups.

Healthcare system priorities are also evolving. There is increasing recognition that effective diabetes management reduces long-term complications and system-wide costs, reinforcing the role of treatment devices as essential rather than optional components of care.

Competitive and Industry Implications

As the global diabetes treatment medical devices market expands, competition is shifting away from standalone product offerings toward integrated treatment ecosystems. Device manufacturers are increasingly focused on interoperability, patient-centric design, and long-term engagement rather than single-point solutions.

The competitive landscape is also becoming more regionally nuanced. High-growth markets such as China demand localization in pricing, distribution, and device functionality. Mature markets such as the U.S. and EU5 prioritize innovation, regulatory compliance, and clinical validation.

Industry participants that align product strategies with regional healthcare priorities are better positioned to sustain growth as the market matures.

Future Outlook

Looking ahead, the global diabetes treatment medical devices market is expected to maintain strong momentum through 2030E. Global CAGR increases from 6.8 percent during 2015 to 2020 to 10.1 percent during 2020 to 2030E, reflecting a durable growth foundation.

Market expansion is increasingly balanced across regions, reducing dependence on any single geography. The long-term outlook suggests deeper integration of medical devices into standard diabetes care pathways, supported by healthcare policy, clinical practice, and patient acceptance.

Rather than a cyclical opportunity, the market represents a sustained evolution in chronic disease management, with medical devices positioned at its core.

FAQ: Global Diabetes Treatment Medical Devices Market

What does the diabetes treatment medical devices market include?

It includes devices used to treat diabetes, such as insulin delivery systems, glucose monitoring devices, and long-term diabetes management tools.

Why is the global diabetes treatment medical devices market growing?

Growth is driven by rising diabetes prevalence, increased focus on continuous treatment, and wider adoption of medical devices in long-term care.

How big is the global diabetes treatment medical devices market?

The market has grown steadily since 2015 and is projected to reach about USD 38.0 billion by 2030E.

Which region shows the fastest growth in this market?

China shows the fastest growth due to expanding healthcare access and rising demand for diabetes treatment devices.

Is the U.S. still important in the diabetes devices market?

Yes. The U.S. remains a major market, supported by strong innovation and high adoption of advanced diabetes treatment technologies.

How is Europe contributing to market growth?

Europe contributes stable growth through preventive healthcare policies and structured diabetes treatment programs.

Why are diabetes treatment devices becoming essential?

These devices support continuous monitoring and treatment, making diabetes management more effective over the long term.

What is the long-term outlook for this market?

The outlook remains strong through 2030E as medical devices become a core part of standard diabetes care.

Are diabetes treatment devices used only in hospitals?

No. Use is expanding rapidly in homecare settings as devices become easier to use and more accessible.

What makes this market structurally strong?

Long-term disease prevalence, healthcare system support, and technology advancement provide sustained market momentum.