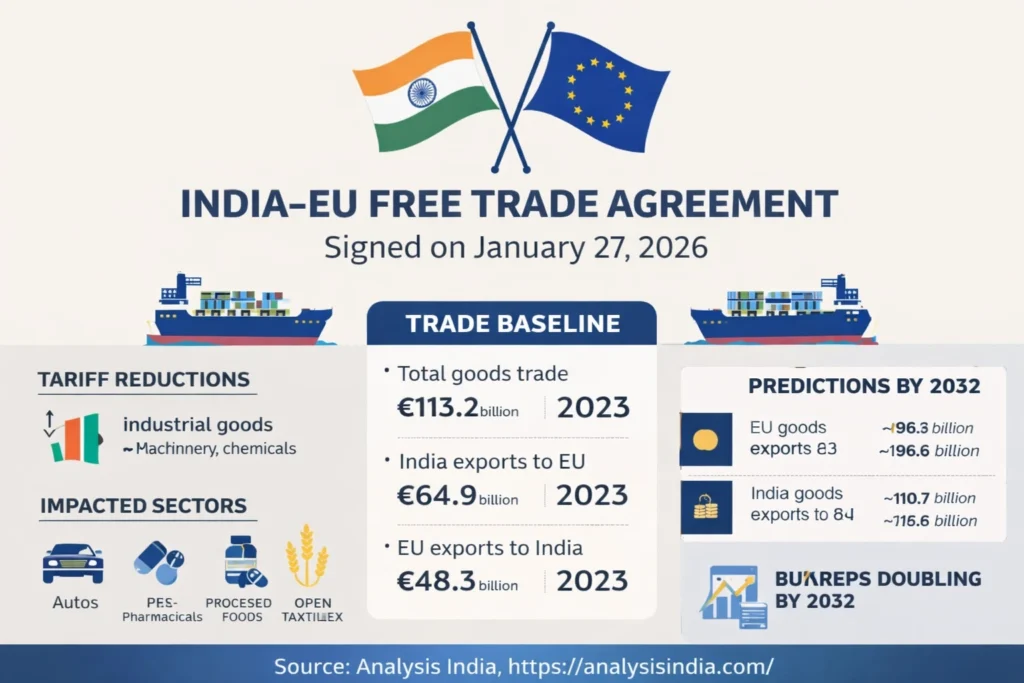

Analysis India. The India EU free trade agreement signed on January 27 2026 marks the conclusion of nearly two decades of negotiations between India and the European Union. The deal represents a major step in reshaping economic engagement between two large global markets. It aims to improve access for goods services and investment while addressing long standing tariff and regulatory barriers.

The agreement opens new commercial opportunities across multiple sectors. It also introduces phased tariff reductions safeguards and regulatory cooperation frameworks designed to manage economic adjustment. Alongside trade provisions the deal is supported by parallel cooperation in clean energy research and broader strategic engagement.

The immediate effects include expanded market access changing competitive dynamics and gradual shifts in supply chains. However the agreement is not yet in force. It still requires ratification by the European Parliament national parliaments where applicable and final domestic approvals in India. Implementation will occur gradually through scheduled phase ins and safeguard mechanisms.

Current Baseline Trade and Services Position

To understand the potential impact it is important to first review the existing trade relationship between India and the European Union using recent official figures.

Table 1 Bilateral Goods and Services Trade Baseline

| Item | Value in euros | Year | Source |

|---|---|---|---|

| Total bilateral goods trade | 113.18 billion | 2023 | Indian Embassy Brussels |

| India goods exports to EU | 64.86 billion | 2023 | Indian Embassy Brussels |

| EU goods exports to India | 48.32 billion | 2023 | Indian Embassy Brussels |

| Approximate total goods trade | Around 120 billion | 2024 | European Commission and Indian press |

| Services trade between EU and India | Around 60 billion | 2023 | EU trade data summary |

Trade data shows steady expansion in goods flows over the past decade. The European Union is one of India’s largest trading partners in goods. Services trade has also grown strongly which explains why services and mobility provisions are central to the agreement.

India EU free trade agreement – What Changes Under the Agreement

Tariff Liberalization

Under the negotiated framework tariffs on a large share of traded goods will be removed or significantly reduced over a transition period. This applies mainly to industrial products such as machinery chemicals pharmaceuticals textiles and jewellery. Lower tariffs are expected to reduce trade costs and encourage two way shipments.

India has agreed to phased reductions for many export lines while retaining longer transition periods for sensitive sectors. The European Union has also committed to improved access for Indian exports under defined rules of origin.

Automobiles and Transport Equipment

Automobile tariffs are addressed through gradual reductions subject to quotas and safeguard mechanisms. This approach reflects the political sensitivity of the sector in India. European manufacturers gain improved access while domestic producers are given time to adjust.

Over time the sector may see increased local assembly joint ventures and technology collaboration depending on investment incentives and local content requirements.

Agriculture and Food Products

The agreement introduces selective liberalization in food and agricultural products. Tariffs on several processed and premium items are reduced while protections remain for sensitive staples. This balance allows limited market opening without undermining domestic agricultural stability.

European producers of specialty foods may benefit while India maintains safeguards for key farm products.

Services Investment and Mobility

Services are a core pillar of the India EU free trade agreement. The deal strengthens access in finance maritime services and professional services. It also introduces measures to ease short term mobility for skilled professionals students and business visitors.

For India services exports are strategically important given its strong global position in IT and professional services. For European firms improved access creates new revenue opportunities in a growing market.

Standards Regulatory Cooperation and Sustainability

The agreement includes provisions for regulatory cooperation mutual recognition elements and sustainability references. There are also commitments to collaborate on clean energy transitions and research initiatives.

Climate related discussions including carbon related measures will continue during implementation as regulatory alignment evolves.

India EU free trade agreement – Projected Trade Effects and Scenario Outlook

Several official briefings and media analyses released alongside the signing of the India EU free trade agreement outline possible future trade scenarios. These projections are not guarantees but offer directional insight into potential outcomes.

Table 2 Scenario Projections by 2032

| Item | Baseline value euros | Illustrative 2032 scenario | Source context |

|---|---|---|---|

| EU goods exports to India | 48.32 billion | Around 96.6 billion | Reuters and major media scenario |

| India goods exports to EU | 64.86 billion | Around 110.7 billion | Trade model based forecasts |

| Total bilateral goods trade | 113.18 billion | Range of 180 to 240 billion | Combined scenario estimates |

These projections depend on ratification timelines implementation quality global demand and reduction of non tariff barriers. Businesses should treat them as conditional rather than assured outcomes.

India EU free trade agreement – Sectoral Impact Assessment

Manufacturing and Industrial Goods

European firms are likely to gain in machinery chemicals and advanced manufacturing inputs due to reduced tariffs. Lower input costs may support Indian manufacturing upgrades. However increased competition may pressure domestic firms operating in similar segments.

The scale of benefit for India will depend on whether imports are accompanied by local investment and technology transfer.

Automobiles and Components

Lower tariffs will initially increase vehicle imports. Over time manufacturers may prefer local assembly or joint ventures to manage costs and meet market conditions. Indian component suppliers integrated into global value chains could gain new opportunities.

Textiles Leather and Labour Intensive Sectors

Tariff elimination creates strong export potential for Indian textiles and leather products. Success will depend on compliance with EU standards quality requirements and logistics efficiency. Investments in certification and traceability will be critical.

Pharmaceuticals and Chemicals

Regulatory cooperation could ease approval processes and reduce time to market. India’s generic producers may gain better access while EU firms may expand presence in India’s large pharmaceutical market.

Services and Digital Trade

Easier mobility and clearer market access rules support services trade growth. Firms will need to focus on compliance talent planning and local partnerships to benefit fully.

Macroeconomic and Strategic Effects

The agreement encourages supply chain diversification and reduced reliance on single source markets. Investment flows are expected to increase as legal certainty improves. Employment effects will vary by region and sector with both gains and adjustment pressures.

Strategically the pact strengthens India EU relations and signals a broader push toward diversified global trade partnerships.

Implementation and Legal Process

Although signed the India EU free trade agreement is not yet operational. Ratification by EU institutions and member states is required along with domestic approval in India. Tariff reductions will be introduced gradually with safeguards applied during early years.

The final timeline depends on political processes and legal review.

India EU free trade agreement – Who Benefits and Who Needs Support

Likely Beneficiaries

Export oriented manufacturers and services firms

European producers of machinery pharmaceuticals and high value components

Indian exporters in textiles jewellery and labour intensive sectors

Consumers benefiting from wider product choice and competitive pricing

Sectors Requiring Adjustment

Domestic producers facing new import competition

Workers in exposed industries needing reskilling

Small firms requiring support for standards compliance and financing

Policy support will be essential to manage these transitions.

Practical Guidance for Businesses

Firms should map tariff changes against product lines

Invest in standards compliance and rules of origin readiness

Reassess supply chains and consider local production strategies

Explore joint ventures and distribution partnerships

Plan early for mobility and regulatory requirements in services

India EU free trade agreement – Conclusion

The India EU free trade agreement represents a major shift in economic engagement between India and the European Union. It offers meaningful opportunities across goods services and investment but benefits are not automatic. Effective implementation supportive domestic policies and business preparedness will determine outcomes.

With careful execution the agreement can support long term trade growth and strategic cooperation. Without adequate adjustment measures gains may emerge more slowly.

India EU free trade agreement – Frequently Asked Questions

Why is the India EU trade deal important now

The trade deal comes at a time when global supply chains are being restructured and countries are seeking more reliable trade partners. For India and the European Union the agreement strengthens economic cooperation and reduces dependence on single markets. It also supports long term strategic and political alignment between the two sides.

What changes for trade between India and the European Union

The agreement lowers or removes tariffs on a large share of goods over time. It also improves rules for services investment and regulatory cooperation. These changes make it easier for businesses to trade invest and operate across both markets while reducing long standing trade barriers.

When will the India EU free trade agreement start to apply

Although the deal has been signed it is not active yet. It must pass legal and political approvals in both India and the European Union. Once approved implementation will happen gradually through scheduled tariff reductions and safeguard measures rather than all at once.

Which industries are expected to benefit the most

Manufacturing machinery pharmaceuticals textiles and services are among the sectors likely to see early benefits. European firms gain better access to India’s market while Indian exporters benefit from improved entry into the European Union. The level of benefit will depend on compliance standards and market readiness.

How does the deal affect Indian exporters and manufacturers

Indian exporters may gain improved access and more predictable trade rules. However they will also face higher quality and regulatory requirements in the European market. Manufacturers that invest in compliance technology and logistics are better positioned to benefit from the new trade environment.

What does India EU free trade agreement mean for European companies

European companies gain improved access to one of the world’s fastest growing major markets. Lower tariffs make European products more competitive while investment protections improve business confidence. Over time companies may expand local production partnerships and long term investments.

Does the India EU free trade agreement include services and skilled professionals

Yes services are a key part of the deal. It improves access in areas such as finance maritime services and professional services. It also supports easier short term movement for skilled professionals students and business visitors which helps services trade grow.

How are agriculture and food products treated

The agreement takes a cautious approach to agriculture. Some processed and premium food items receive tariff reductions while sensitive staple products remain protected. This structure helps manage domestic concerns while allowing limited market opening.

Will this deal change supply chain strategies

Many businesses are expected to reassess supply chains in response to the agreement. Companies may diversify sourcing invest closer to key markets or expand regional production networks. Over time this could strengthen trade links between India and European manufacturing centers.

What are the main uncertainties to watch

Key uncertainties include the speed of ratification political developments and global economic conditions. Non tariff barriers regulatory alignment and implementation quality will also influence real world outcomes. Trade growth projections should be viewed as indicative rather than guaranteed.

How should businesses prepare now

Businesses can start by tracking approval timelines reviewing tariff schedules and assessing compliance requirements. Early planning around supply chains partnerships and regulatory readiness can help firms move quickly once the agreement becomes operational.